Why Venture Building is unusually suited for Crypto

Understanding the range of ecosystem engagement activities, and why we will see why Venture Building will emerge in a greater way in the Crypto ecosystem.

Venture Building has historically not featured in crypto, until recently. Venture building, thought of as more centralized ecosystem development approach, is generally unintuitive for decentralized-native crypto ecosystems. The ethos of decentralization of course is to empower others to build, as opposed to building on our own. Yet, I believe we will see Venture Building emerge as a key differentiator in the current crypto kingmakers: Protocols, Exchanges and Tier 1 crypto-native funds.

What is Venture building? Venture builders are organizations that build startups, using their own ideas and resources. Technical and management teams of a startup would typically be under varying levels of employment by the main Venture builder entity, which reflects the range of ‘venture building’ models that exist in the market.

Ecosystem engagement (ranging from the level of resource commitment) can be seen below to better contextualize Venture Building from the range of other options:

Diving into the different models of Venture Building specifically:

As I’ve written before - If you can’t find it, build it. This has been an attitude taken by a number of venture funds (crypto/non-crypto) who find that they hold the keys to a number of important factors of building a highly successful company: Access to talent, capital, and an understanding of what needs to be built.

On the highest spectrum of venture building, companies like Rocket Internet have famously built and sold billion dollar companies like Lazada, hiring co-founders to build from scratch to acquisition. These funds tend to own the vast majority of the cap-table.

Moving downwards, venture builders like Superlayer, Advanced Blockchain have been known to work with promising founders on the initial idea, provide the initial Seed capital, and with key members of the founding team under the employment of the parent venture builder. These venture builders typically then continue their involvement with the company as an investor into their later rounds and typically own outsized but not significant majority stakes in the company.

Working in a similar manner, though on a shorter-term basis, companies/programs like Antler, EF work with individual founders in a programmatic manner, and help them find cofounders to start companies together, investing an initial pre-Seed/Seed capital. Post-investment/program, the founders are typically left to build their companies, with some support from their investors (who typically generate hundreds of companies through this model).

For Crypto, a range of venture building options are available, though I generally suspect the VC-as-a-Co-founder approach (Early-stage/ Short-term) will be the approach that best balances founder incentives and capturing opportunities reliably for crypto organization, given the wider range of needs that a Web3 company would need (liquidity, tokenomic design, multi-chain support, etc).

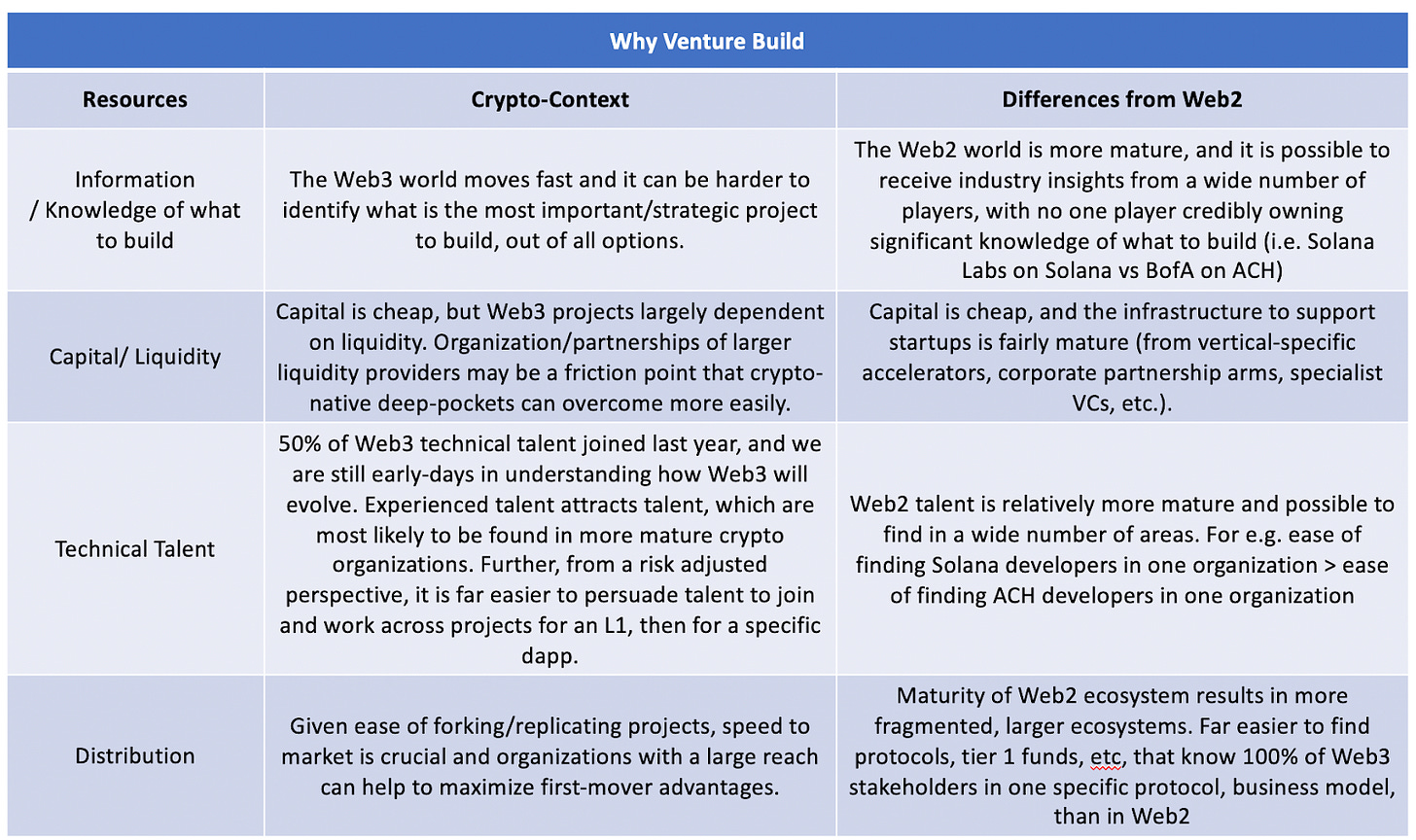

The main principle for why one should go deeper into Venture Building would be driven by external factors of industry bottlenecks - specifically on a relative scarcity of resources. In an environment with high levels of industry bottlenecks, where a player owns a relatively disproportionate level of resources (capital & non-capital) to overcome said bottlenecks, venture building is recommended. These resources can include information, capital, talent, and distribution, which see an unusual concentration of such resources among the crypto kingmakers of protocols, exchanges and tier 1 crypto-native funds.

In the traditional Web2 world, with the examples given above, the resource scarcity that those venture builder examples had were fundamentally around talent, capital. The resource that Rocket Internet was gathering was talent and capital arbitrage of emerging markets (back when it was hard to find both in places like Africa, South Asia, LATAM, Southeast Asia in the early 2010s). The resource that EF/Antler have is optimizing for cofounder talent density and the difficulty of finding co-founders.

Furthermore, crypto’s unique characteristic of leaning towards being an open-source decentralized platform also contributes to the likelihood of venture building proliferating. Founding teams that have successfully created a dapp or protocol can find themselves in the position to decentralize both governance and product building for that dapp or protocol, let the community take over, and focus on a new project without necessarily compromising its growth (For example, as seen in Sushiswap which continued growing as a prominent dapp despite the founder leaving). This is in contrast to a closed organization where the departure or even split focus of the management team would dramatically affect the output of the organization. The capacity of leadership teams to switch project focus gives greater space for venture-building to exist.

Protocols in particularly have the highest strategic reason to venture building. From the spectrum of light-touch evangelizing to heavier-handed venture building, we will see protocols increasingly more to the latter, in a ‘crypto super-ecosystem’ approach to venture build D.apps/use-cases across their own ecosystem to increase protocol adoption. Protocols have a single incentive - To increase utilization of the protocols. Protocol teams are doubly motivated to venture build on their own protocol - because they can capture the value of a newly built D.App, but also increase the utilization of their protocol, increasing the number of use-cases for their consumers and increasing protocol mindshare.

Within Crypto specifically, we have already seen this trend of venture building by protocols. The most prominent example of this was where the team behind Luna built out Chai payments, Anchor and Mirror, all applications which helped to increase consumer adoption of the Terra ecosystem, which increased the value for others to build on Terra. The Generalist notes that this unusual approach allowed Terra to build products in which it can act as its “own first, best customer”, similar to how Amazon similarly created tech products like AWS for which they were their first customers.

Solana has also recently announced the launch of Solana Pay, built by the Solana Labs team. Solana Pay is not only a needed business model in itself (leveraging cheaper transaction costs to allow crypto merchant acceptance, with instant settlement, lower merchant fees, and an ability to serve lower margin industries that already struggle to accept credit cards [e.g. Gas Stations, Cross-Border payments, etc]) but will also strategically drive the adoption of SOL and the Solana ecosystem.

In contrast, Ethereum has historically not been a place where we see such high-profile venture building by the ETH foundation, though displaying some elements of incubation and grant-making. Vitalik has been a driving force for new ideas on crypto-primitives that 3rd party founders have built out on Ethereum (Vitalik’s thoughts on AMMs inspiring Uniswap for e.g.).

Moving forward, we can expect to see organizations increasingly diversify their ecosystem engagement strategy, with a spread of grants, venture capital investments, and venture building organizations, potentially as separate entities. Given that venture building, for example, cannot be executed well as a part-time strategy by developer teams, we will see an increased focus for standalone venture building organizations that are specialized in running processes to identify, build and capture value through dapp venture-building.

In conclusion, the relative resource scarcity, dominance of crypto kingmakers, and the nascent nature of the Web3 ecosystem have set the scene for the disproportionate growth of venture building in Web3 as a means for strategic competition. Newer protocols have paved the way for some of this activity and moving forward, I expect to see more Exchanges and Tier 1 Crypto-native funds build out venture building teams and organizational capabilities as a means of competing, and as the future for Web3 value-creation.

Thanks to Shaun Heng, Chiyoung, Jack Chong, Matt Sorg for their comments/input. Input does not mean endorsement.