UPI & Crypto: Super-App Product Ecosystems & Monetization Metas

Understanding what UPI has to teach for crypto founders and investors - super-app/product ecosystems are more inevitable in crypto, and the monetization metas that exist in both fintech & crypto.

I used to invest in emerging market fintech, and have always held a strong belief that many aspects of crypto resemble fintech in ‘thin’ emerging markets. Thin is defined by the economic depth of the market, through which GDP per capita is a proxy metric. These markets demonstrate difficulty monetizing, a need to build core infrastructure internally, distribution and user education challenges, with large public and private incumbents occupying monopolistic market share. The ecosystem around the Unified Payments Interface (UPI) in India is a fantastic example of some of these challenges, particularly around the ability for companies built on UPI to monetize on what are public rails.

The main lesson I learnt from those experiences was that success meant an intense ability to build a product roadmap that focused on occupying mindshare of extremely valuable customers within existing markets, and which had an incremental ability to monetize through a wider range of revenue streams than traditional startups.

There are two points I want to make for fintech and crypto investors and founders reading this. The first is comparing the monetization routes for businesses on UPI versus Crypto, and the monetization meta that arises. The second is on the product ecosystem philosophy that arises due to monetization issues.

An Introduction to UPI

UPI is an instant real-time payment system set up by the Indian government that is lauded as one of the most adopted, near costless, and effective payment systems in the world. The adaptability and adoption of UPI blow most digital wallet ecosystems out of the water by comparison. As an aside, it has always been interesting to me that crypto has been compared to digital wallets when UPI is the better comparable. An example of this is payment interoperability. In the case of wallets, the sender and the receiver have to be registered with the same wallet app to make a transaction. If the sender uses Brand #A wallet, the receiver is required to have the same Brand #A wallet to receive the money. In comparison, the UPI transaction takes place between any two bank accounts, irrespective of the UPI application used to make the transaction. For example, using Google Pay, a sender can transfer money to a receiver who has Phonepe (another UPI payment provider) installed. Further, the largest wallet ecosystem is in China, which has a centralized duopoly wallet ecosystem, completely antithetical to an open-source, composable standard that is crypto.

One problem that arose through the creation of UPI is the difficulty that companies have in monetizing the products they build on top of it. Driven by government mandates and by the open competition that UPI enabled, UPI payment features are near impossible to monetize. There is stiff competition for P2P mindshare and nobody wants to introduce a fee that would certainly hurt competitive positioning. Switching between UPI applications is very easy because the apps do not control the user’s bank account or underlying data and cannot create a switching cost based simply on access to previous transaction data. This is like the crypto world where applications cannot hold users captive because access to underlying data is open.

A similar problem exists in crypto. Where there is an easy ability to fork a swap contract and provide it with zero fees, the ability for crypto companies to monetize is threatened. This was less of an issue during the bull cycle, given how nascent and few the existing dapps were, as well as monopolistic tendencies for liquidity. As we began to see with the fork of Uniswap by Sushiswap, and with the influx of venture-backed companies, and the lowering of liquidity during the bear market, it became more difficult to become a monopolistic rent-seeker.

Understanding Monetization in UPI and lessons to bring to Crypto

Let’s look at what some of the UPI-based businesses in India have done to create value-added moats, in the context of a harder monetization path:

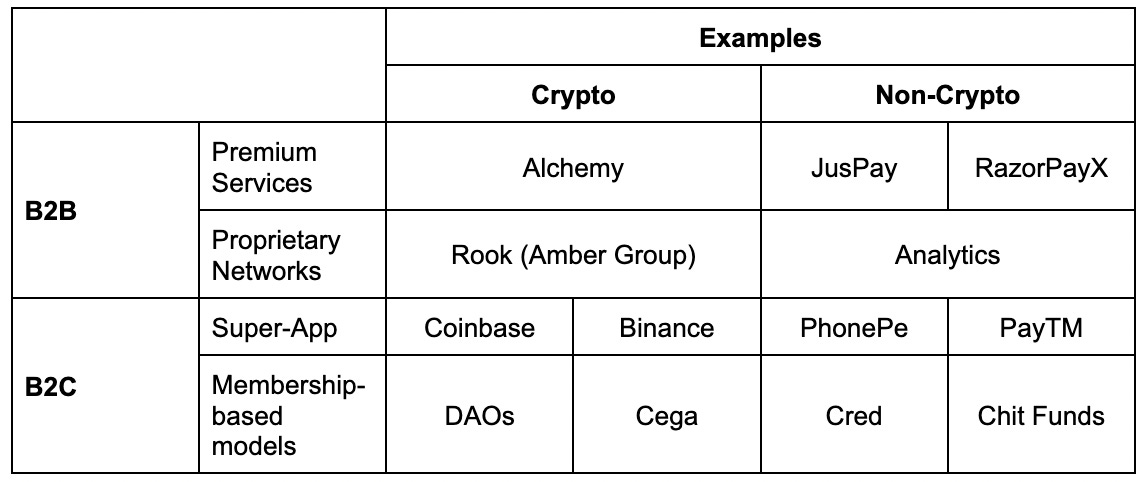

Before diving into the table, I want to mention the Monetization Meta. With difficulty monetizing in fintech, there was always an arms race to discover the next product that could potentially help to break monetization stagnation. Occasionally, a new monetization meta will emerge with higher take rates that become an attractive monetization feature to add to every roadmap, regardless of cohesiveness to the product roadmap. In fintech, lending (monetize through interest or origination) and card products (transaction fee) quickly became one of these go-to feature sets as infrastructure to embed lending and card products matured. I used to joke that card-issuance-as-product-market-fit was a meme, as almost every fintech had card issuance in their roadmap, regardless of the business model. How many cards/bank accounts did everyone expect the average person to have? For fintech folks in the room, I always joked that staking and MEV are the new lending/credit card.

In crypto, the initial infrastructure meta around monetization through transaction-take swaps or issuing governance tokens, has shifted recently to stablecoins, MEV capture, and staking. New monetization metas will continue to evolve and shift, as narratives have already shifted to compressing staking take rates during this bear market. As with any infrastructure meta, as competition increases, take rates compress, and the industry develops a new meta for adoption or as a monetization narrative.

B2B Business Models: Premium Services

In this model, UPI businesses create superior features that are more reliable, robust, and have higher success rates, and charge a fee for such higher performance, on existing rails.

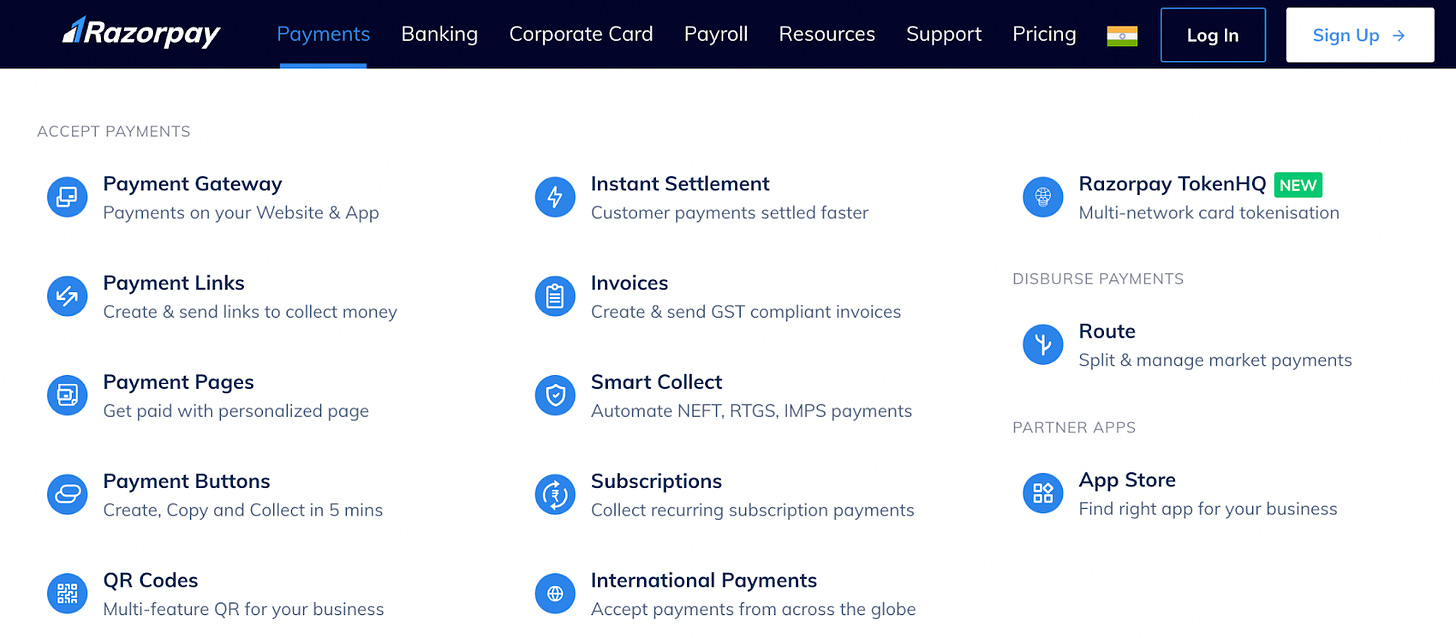

JusPay (Softbank/Accel-backed) and RazorPayX (TCV/GIC/Tiger-backed) are great examples of businesses that have successfully created a moat by enhancing API access to existing public rails. They do this by building solid infrastructure and features that premium clients demand and are willing to pay a fee for. Juspay works with FI partners to create infra that sits within the bank environment. They speed up the processing of UPI services, resulting in much faster, and more reliable throughput. Similarly, RazorPay offers merchants a bank account with deep integrations to ancillary services like accounting software, etc.

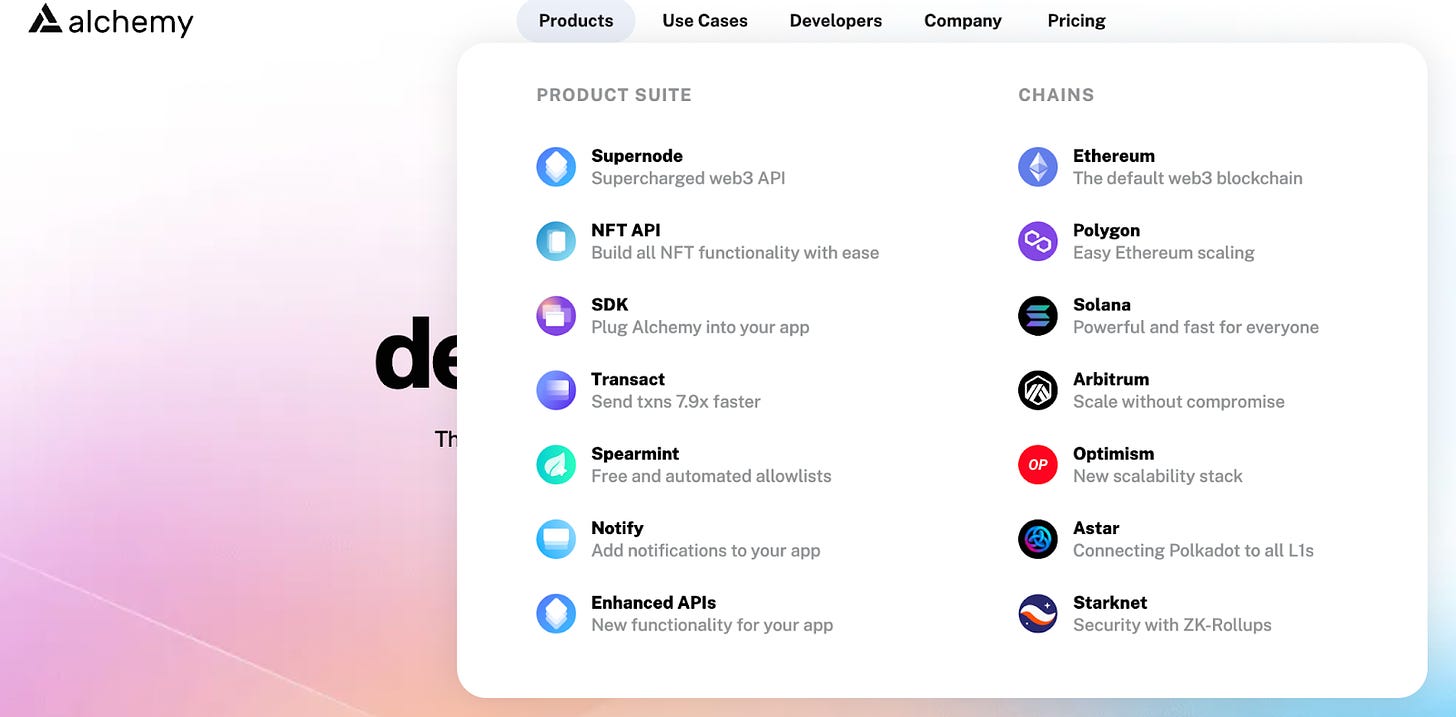

Similarly in Crypto, while the blockchain is theoretically open and permissionless, there is work that goes into interacting with the blockchain more efficiently. Alchemy (Pantera/Lightspeed) exists to help provide an easier and more enriched way of interacting with the multitude of blockchains that exist out there in the market, with APIs that allow better data extraction, faster transaction execution, and transaction monitoring.

B2B Business Models: Proprietary networks

While UPI is inherently interoperable, some companies create moats from their proprietary networks on top of the open network, typically around data, and consumer cross-sell.

One crucial difference in crypto versus UPI is that while the value of proprietary networks in UPI/fintech is on the data they collect on the transactions they help process, the value of proprietary networks in crypto is the transaction itself that they help to control.

For example, while plenty of fintech companies derive their value in the data they collect, allowing them to cross-sell products, crypto companies can largely only capture value in the control of the transactions that flow through their platform. Crypto analytics businesses of course exist (Nansen/Messari), which have a role to play in the ecosystem, but it is certainly true that the data moat that crypto companies have over fintech companies are relatively thinner.

In Crypto, the ability to control transactions allows platforms to do interesting things like capture MEV revenue through private memepools, bundle transactions, etc, in ways that are reminiscent to payment for order flow that non-exchange fintech companies are not exposed to, but which all crypto companies have a gateway into, from wallets to defi smart contracts, to centralized exchanges. Rook, a private memepool, run by Amber Group, is an example of transaction flow being captured in a proprietary network, with MEV rewards redistributed to users, reducing their transaction fees.

B2C business models: Club/Membership based model

Creating exclusivity for access to specialized products is another way in which some companies have successfully created a niche. In this model, users get access to special privileges or features only if they are part of a club or membership program. Companies are experimenting with different ways to define club membership requirements, with Cred being an example of this. Cred’s base feature allows users to easily pay all kinds of bills via UPI for free and uses their club membership model to gate access to special deals and more advanced social features. This creates a social network moat allowing them to attract better deals and advertising revenue.

This is a very natural fit with Crypto today, with DAOs and NFT gating becoming a popular strategy to create a strong core set of users and grow outwards from there. However, creating a sustainable and continuously evolving/engaging membership benefits program is hard. This is also applicable in DeFi, with companies like Cega offering certain risky DeFi products only to their large NFT whale customers, who have presumably indicated a higher risk profile by investing large amounts into their NFT collections.

B2C business models: Super App model

In this model, users are nudged to trust the app for payments and money, and over time trust the same app for many other daily activities such as food orders, groceries, shopping, financial solutions such as bill payments, buying insurance or credit cards, etc. The user benefits are that the app aggregates several user needs in 1, which would otherwise require several different apps. For service providers this is a great source of new user acquisition. Building the initial foundation of trust - strong tech, cheap transactions, great security, etc. are critical to building this super app ecosystem. Examples that have successfully built strong businesses based on this model are Google Pay, PhonePe and PayTM. WeChat remains the largest Super App success story in Asia.

In Crypto this model naturally fits well with Wallets, CEXs, DEXs, and Onramps which are typically the gateway to web3 for most users. As a result, we have seen some of the larger, more profitable business models leverage their user-base to become an all-in-one service platform. Especially given that the core limitations of crypto remain trust and distribution, super-app dynamics tend to work especially well in crypto.

We will explore the super-app/product ecosystem idea in detail later.

So what are the takeaways that this comparison teaches us?

For Founders:

Keeping a close eye on the monetization meta. Network effects for capital and distribution advantages exist2, and this becomes a backbreaking operationally intensive business to focus on shipping a series of products that have short-term supernormal returns, and long-term fee compression.

For Investors:

Understanding that we can observe many fintech markets in India and other emerging markets like China to understand how monetization in crypto evolves.

Understanding that monetization in crypto will likely not be concentrated from a single product

Product Ecosystems/ Super-App models

The main lesson about building fintech companies on UPI has been about the need to expand across product sets, and to focus on building a network effect across product suites. At the core of this is understanding how to build strong product cross-sell and if the product ecosystem appropriately captures the full current and future product needs of its customers.

The underlying principle here is that where the underlying rails prevent opportunities to monetize, the acquisition of transaction volume becomes a mindshare battle to cross-selling other products where monetization can be found. In the best-case scenario, feature sets should overlap to create a deep network effect and stickiness. In the worst-case scenario, simply acquire resources and act aggressively enough to win a range of ‘shallow’ market opportunities.

Such product ecosystems or super-app dynamics should be far more prevalent in crypto because of the increased need to monetize through a range of different products. The realities of building on public permissionless rails compress take rates for the vast majority of products. Having personally seen a handful of products where 7-8 figure subscription revenue is the norm, the product roadmap for most infrastructure players default to product ecosystems. The underlying question product teams have to answer are: Are the feature roadmaps within our ecosystem best reflective of how the ecosystem will eventually develop?

Network effect within product feature ecosystems, brand value, community development, developer experience/mindshare, and capital as a moat all become underlying principles for differentiation.

A few examples of this can be found across UPI and crypto.

PayTM: One of the leaders in UPI adoption, the publicly listed PayTM has created an ecosystem around payments, e-commerce, advertising, and asset management.

Razorpay: Similarly, Razorpay, the $7.5B Temasek-backed merchant payment provider on top of UPI has created a product ecosystem approach, across payment, deposit, cards, and payroll features. Razorpay can be seen as the Stripe for India, but with a far more extensive product suite.

Alchemy: Alchemy began as RPC node infrastructure by providing faster and more reliable Ethereum node infrastructure, that ended up expanding across the stack to become the AWS for crypto, and a $10B Silver Lake-backed developer platform.

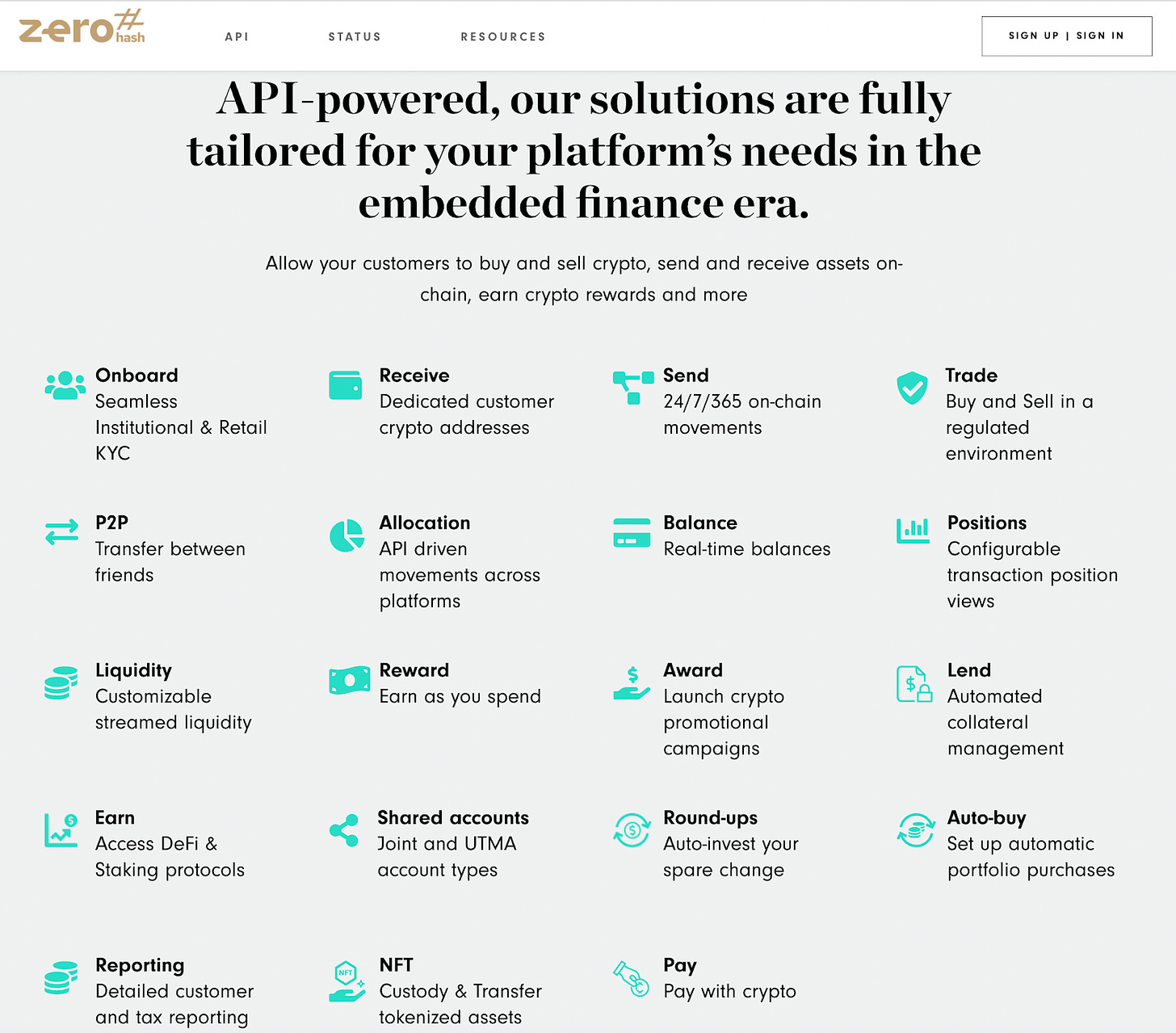

ZeroHash: ZeroHash has built an extensive product suite, leveraging its position in the market to offer a range of services, given the relatively nascent demand for each point-solution.

So what are the takeaways that this comparison teaches us?

For Founders:

Realizing that a product ecosystem approach is inevitable for many businesses to reach VC scale in crypto today, understanding that you need to build mindshare with the first feature set, and immediately be competitive on monetization with the subsequent features shipped.

For Investors:

Understanding the realities of the product ecosystem / super-app approach. The good thing is that although it seems like an incredibly difficult thing, and far different from the ‘singular killer use-case that builds a product moat’ approach that we see in other industries, the resultant product ecosystem moat is hard to outcompete with a good team.

As founders building in crypto double down on finding product market fit, I have a strong belief that many traditional fintech lessons will return to the fold of crypto, and many lessons from other traditional fintech payment ecosystems around the world, and particularly in emerging markets, will be highly relevant to crypto moving forward.

====

Thanks a lot to Aditya Gupta [PM @ Google Pay], Mihir Kulkarni [SVP @ Truist], Utkarsh Bajpal [Investor @ Elevation] for their comments/input. Input does not imply endorsement.