The Three Debates of the Layer Zero (L0) Wars

I discuss the foundational debate between universal v local security, how founders can use cross-chain infrastructure to build new native token yield for their dapps, and cost trade-offs.

Debate #1: The Modularity Vision: The Global v. Local view of Blockchain security

Debate #2: A New Model of Tokenomic yield: Using dapp native tokens to secure the chain

Debate #3: Comparative Costs Structures: Variable v. Fixed costs structures

By now, most people would have heard of LayerZero and a large number of announcements in the cross-chain generalized interoperability space (“L0”). There are a thousand articles (Anti-Ape) about how powerful the L0 space can be, given its ability to abstract away every L1 in existence.

I wanted to give some clarity on how to think about design choices between Axelar, LayerZero, and other cross-chain projects, and the overlooked nuances of these projects, by focusing on 3 key pieces of differentiation that will be key: Global v Local Security, Native tokenomics, and Comparative Costs Structures, and answer the question about how to think about who would win.

The Modularity Vision: The Global v. Local view of Blockchain security

LayerZero’s core differentiator and the chief lens to view the industry is on design choices on modularity, of which LayerZero represents the extreme end of providing modularity. LayerZero passes transaction messages through a relayer and secures them with an Oracle that must confirm the veracity of the transaction message. LayerZero provides the infrastructure to coordinate cross-chain messaging but allows dapps to choose both the relayer and the oracle that a dapp may use, rather than mandating a specific actor for either.

One of the criticisms about LayerZero is on their existing security set-up, currently centralized, as the oracle used is the Industry TSS Oracle, and the relayer used is the relayer run by LayerZero.

These are misconceptions as LayerZero is over time, looking to be a completely agnostic modular infrastructure, with a ‘marketplace’ of relayers and oracles for developers to choose from.

In essence, LayerZero is not prescribing the full security profile that multi-chain dapps will use, but rather takes a modular approach to allow dapps to decide how much security they want to design and adopt, with the burden of security design choices on the developers.

The bull view is that LayerZero is giving greater security design choices for developers. The bear view, which is also a humorous description, is that LayerZero is thinking about security by not thinking about security. Instead, they aim to provide the choice and probably over time, provide content and education around best practices that developers can choose to adopt when choosing their own set-up on top of LayerZero.

It is interesting that this debate on blockchain modularity is not new, either to blockchain or even in tech. We had similar debates between Linux and Microsoft, fundamentally presenting 2 different views on creating ecosystems - more customizable solutions to provide choice or more standardized solutions for ease of adoption. DevConnect 2022 had a fantastic panel on this exact conversation.

The key contention is whether you believe the right way to build infrastructure is to follow Celestia and other modular infrastructure that let developers design their underlying infrastructure or follow Solana and focus on increasing adoption by building more monolithic and standardized blockchains that restrict choice, but may be easier to adopt and understand. As David Phelps phrases it - “[this] is two very different visions of the future: do we want universal consensus for global connectivity or local consensus?”

This brings us to Axelar. Axelar and LayerZero present the essence of a similar debate, with LayerZero providing the infrastructure to enable more ‘local’ consensus networks, and Axelar providing a more global approach, as each Axelar node helps to secure each other, creating more universal consensus/security. Axelar uses an intermediate consensus layer to demand that there is a basic standard of consensus (i.e. rules that determine whether a message is verified to be true) that must be set, that is applicable to any message transfers on Axelar. This is in contrast to LayerZero which sets up the infrastructure but lets dapps decide on the rules and consensus required to approve a transaction on each dapp.

The founders of Axelar and LayerZero debating whether Axelar’s universal security model is the better approach.

The specific trade-off for users, founders and developers would be:

Users: Mainly security, with a greater variance in security expectations. There would exist a possibility that the dapp’s utilization of LayerZero may be poorly designed, or have specific security vulnerabilities. On the other hand, this might represent greater security if developers use LayerZero to institute higher dapp-specific security for their relayers.

Developers: The ability to implement/create your choice of relayer and oracle (including a centralized relayer, or a third party decentralized relayer), though increasing the need for each developer to understand and make a decision on why one choice is better than the other.

Modularity in itself also has security implications. A monolithic security structure like Axelar, with its intermediate consensus chain, might create more formidable security since resources are pooled into a single universal security structure. On the other hand, the failure of the intermediate consensus chain may result in the catastrophic loss of all assets secured by Axelar nodes. In contrast, as LayerZero is merely a modular messaging infrastructure, any single dapp being compromised using LayerZero has no knock-on effect to compromising assets being managed by another dapp using LayerZero.

A New Source of Tokenomic yield: Native Tokens & Value Capture

One thing I am particularly interested in seeing moving forward is how dapps building on top of L0s will make decisions on using their native tokens to secure validators. My view is that validator tokenomics will be one of the next huge topics that founders will have on the top of their mind when LayerZero utilization increases. This also has huge implications for LayerZero’s own value capture framework.

Founders will increasingly understand that they can build additional utility for their dapp’s native token by using using their native tokens as a slashing penalty to secure cross-chain validators. This essentially turns every native token into a potential proof of stake dapp, allowing a dapp like Aave to allow users to stake the Aave token when Aave processes cross-chain transactions. This provides another token sink mechanism by incentivizing lock-ups, and even an income stream for stakers and the protocol itself by charging a transaction fee that feeds into the staking yield for validators of cross-chain transactions. So far, only LayerZero above has discussed this publicly although other cross-chain protocols like Axelar have privately noted that this is a utility that founders can also build on top of their own cross-chain infrastructure. It is potentially slightly more complicated to build this feature on non-LayerZero infrastructure, given that most other cross-chain infrastructure have their own native validator tokens that need to be built underneath the ‘native proof of stake’ mechanics.

For example, Axelar will be launching their native token soon, and the AXL token will be used to help secure the AXL network through staking rewards/slashing penalties.

Since LayerZero has not publicly launched their token, another interesting tokenomics question is whether ecosystem incentives are aligned when individual actors may use LayerZero without LayerZero tokens. This is as there are no obvious token incentives to build on LayerZero. The LayerZero team may be attempting to purely focused on building for the community, and achieve a pure form of product market fit, unencumbered by tokenomics, specifically providing infrastructure to dapps who need cross-chain infrastructure rather than profiting from the next hot crypto project. When asked, the cofounder of LayerZero, Bryan, hints at this view by stating that big grant programs at the onset may attract mercenary developers that may crowd out and distract core believers who are aligned with LayerZero’s value proposition.

One question that may be posed given the current structure would be what the value capture mechanics would look like for LayerZero, given their light tokenless model. A governance token model would bring speculative value, but given the lack of utility for a L0 token, it is unclear what the value capture mechanics for LayerZero would look like. My personal guess is that over time, the LayerZero team will see value in building their own dapps on LayerZero, or end up leveraging a LayerZero token as a currency that dapps may choose to use to stake their validators (in spite of incentives by dapps to do the same for their own native tokens).

On the other hand, with a native token, Axelar’s value capture mechanics are more straightforward. Growth of the AXL network promotes the AXL token value, rewarding early dapps and adopters of the AXL network, unlike early adopters of LayerZero. It is therefore ironic that the market currently views LayerZero as the ‘sexier’ infrastructure, despite a lower ability for the community to monetize from LayerZero’s growth. With the launch of the AXL token in June 2022, there is scope for this to change.

Comparative Cost Structures: The cost trade-off

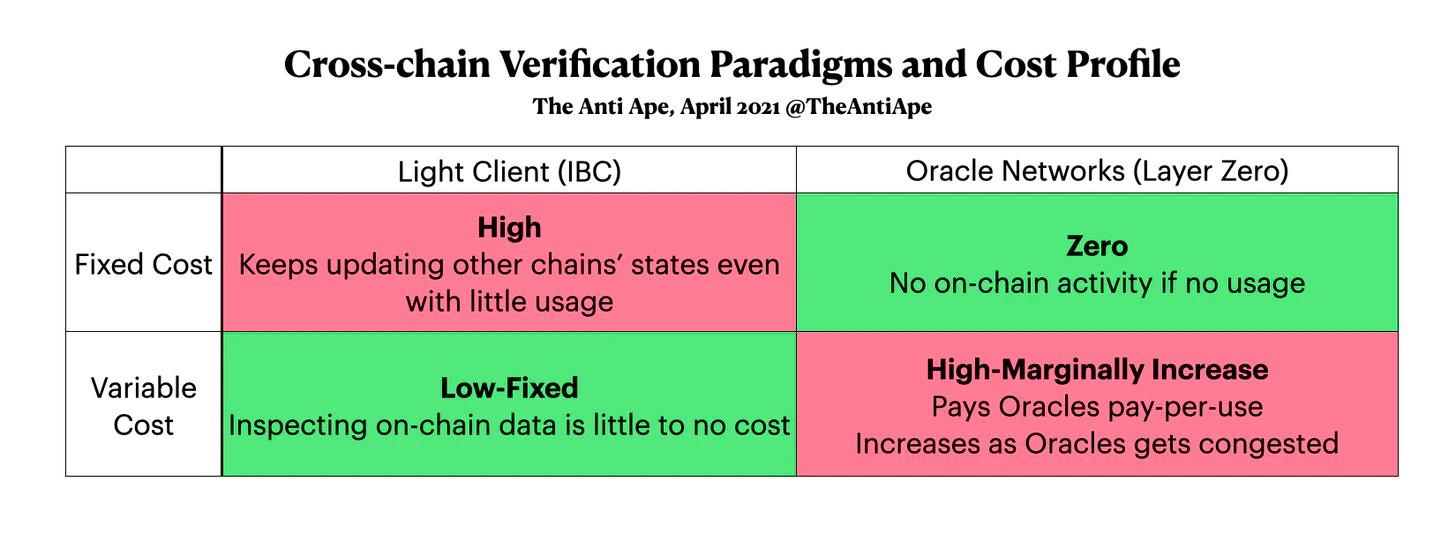

LayerZero’s model also assumes a specific cost-trade off which may be more applicable to specific business models and transaction types. With their current model, LayerZero’s reliance on a third-party oracle incurs a higher variable per-transaction fee. Oracle networks have a marginally increasing cost-per-use, especially as there is increased demand for Oracle services. On the other hand, Axelar runs light nodes, which have a high fixed cost, but can be accessed with little to no variable cost per use.

Tascha notes the differences in costs also have implications on the growth rates of both L0s, with Axelar taking a ‘slower but steadier’ approach to building out the infrastructure layer.

Anti Ape lays it out here nicely, arguing that IBC and L0 will likely co-exist to serve different use cases. Arguably, lighter models like Axelar or IBC solutions will be more suited for high volume transactions in:

GameFi

NFT mints

Consumer payments

Anti-Ape’s argument implicitly assumes that there will be a limited number of Oracles used in practice, leading to congestion of the Oracle network over time, and thus the variable cost per message. It is important to note that Anti-Ape’s argument does not hold in a hypothetical universe where there is an infinite number of Oracles to choose from in practice.

LayerZero is likely to find a stronger product-market-fit for larger transactions and for DeFi dapps which may want specific types of consensus mechanics, especially for high-gas fee chains where the variable cost is high, for example in, ETH-Solana cross-chain DeFi loans.

Design choices affect use cases. Nomad, as a cheap optimistic cross-chain messaging platform requiring 30 minutes for finality, is potentially suited for large whales and dapps that are willing to wait for 30 minutes for a transaction to be completed in a cheap manner.

It is important to note that both the Axelar and the LayerZero teams dispute the above characterization, arguing that their model are better suited for the entire spectrum of both DeFi, GameFi, etc.

Axelar argues that standardized security is especially crucial for building trust in DeFi as an industry. Users and even other developers would not have the time to necessarily examine all potential loopholes if each dapp builds their own customized security.

LayerZero argues that a standardized security approach is inflexible and potentially especially costly for high-frequency transactions like GameFi. With a single consensus mechanic shared by all types of dapps, the protocol would need to establish a high basic level of security. This will mean that dapps with higher security requirements would essentially be subsidized by lower-security/higher-frequency dapps that inherit and pay for, but not require such high-security requirements.

How to think about who will win?

The L0 wars are not won by code, but by adoption. It is not just about how much transaction volume goes through LayerZero and Axelar’s bridges (Stargate/Hop) because then you are just thinking about building better bridges, but how you are able to build the foundational infrastructure for native multi-chain dapps to build on top of.

The main driver of thinking about who will build on which L0 is to think about the value of developer choice. Do dapp developers really want to make security design choices? This is the fundamental stake in the ground that LayerZero is tying itself to. LayerZero’s edge is to introduce choice and modularity, which will only win if developers and the community appreciate the customizability of security. Recent headlines of high-profile on-chain compromises seem to indicate that while security will be a greater area of focus, the way people believe best to achieve such security is still unclear.

From this view, two easy things to track are:

How much experimentation are developers doing with the oracle/relayer combination (either using LayerZero or using different choices as the oracle or relayer)?

There are 2 sub-questions here. First is an ideological view: is modularity worth pursuing even if it leads to less total net secure systems (i.e. high variance of security across dapps)? Second is a utilitarian view: will modularity lead to competitive market forces that will lead to greater total net secure systems? LayerZero will exist where the answer to any of these questions is yes.

An early indication of engagement with these questions is through developer experimentation. Lower experimentation indicates developers are happy to use default trust assumptions. One fear I have is that while there will be a desire for dapps to have a customized relayer, there is not a wide range of reliable oracles to choose outside of Chainlink, and LayerZero will end up only providing modularity over the relayers, and relying on only Chainlink by default, limiting the total net value of modular infrastructure. This increases the potential for Chainlink’s CCIP to disrupt LayerZero since they provide very similar infrastructure with Chainlink’s CCIP infrastructure providing slightly deeper off-chain data infrastructure on top.

How excited are founders to leverage their tokens for cross-chain validator revenue?

How governance tokens can continue to capture value, especially with increasing SEC scrutiny, is already beginning to be one of the key questions dapps are looking to answer. LayerZero has the potential to allow every single dapp to build Proof-of-Stake-type revenue streams by conferring staking revenue streams to their governance tokens. I have yet to see much founder attention to this topic, but it will likely continue to grow once founders start to understand the power of this mechanic.

One interesting implication that I have yet to see popularized is a more modular compromise within the ecosystem, with an Axelar-type infrastructure with universal security but with LayerZero-type custom tokenomics. Universal security and custom tokenomics are largely opposing objectives, but I think that a middle ground can potentially be achieved through a dual staking model (staking of native bridge tokens + staking of native dapp tokens).

Thanks to Mings.eth, Michelle Lai, Bryan Pellegrino, Ryan Zarick, Galen Moore, James Friel, and Georgios Vlachos for input. Input does not mean endorsement or agreement with article.

Links to the best reads in the L0 space:

AlphaPls, Anti-Ape, CoinYuppie, LayerZero Medium, Axelar Blog, Mings.eth