The End State of Bridges - Unified Stablecoin Bridges

I talk about 2 opportunities I see in the market around Cross-Chain Infrastructure and the implications of a Unified Stablecoin Bridge, looking at liquidity, finality and security.

We are still so early for cross-chain infrastructure. It seems to me that there are only 2 end-states for bridges - ZK bridges, and what I call ‘Unified Stablecoin Bridges’ (USBs).

ZK bridges are bridges that rely on ZK proofs to create trust-minimized cross-chain swaps. Examples of these include platforms like Succinct.

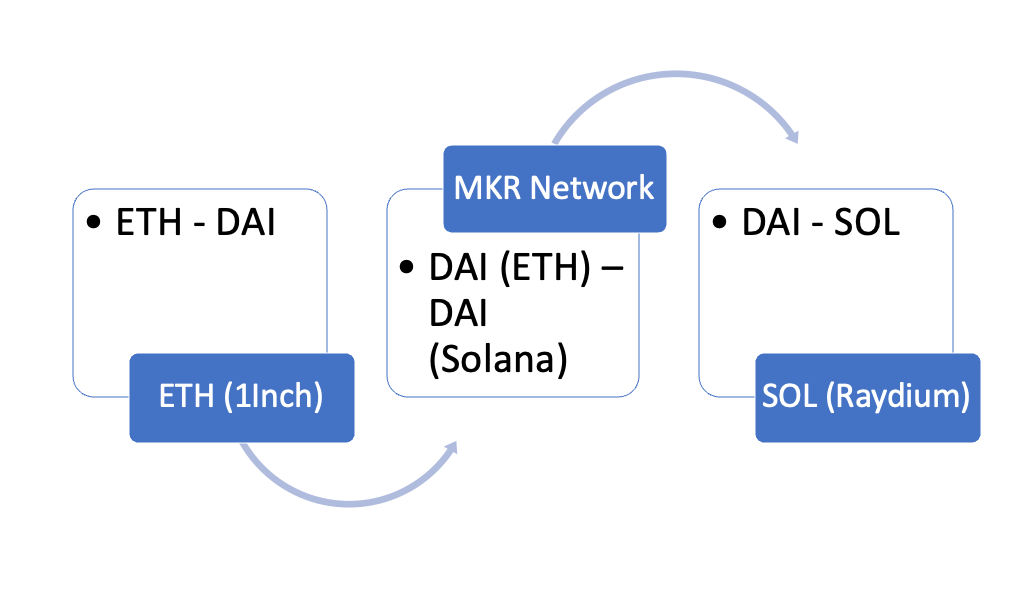

USBs essentially work by aggregating dexes on a sending chain as well as a receiving chain. When a cross-chain transaction is initiated, the bridge swaps assets into an intermediary canonical stablecoin on the sending chain, conducts its value transfer in stablecoins through the intermediary centralized/decentralized stablecoin issuer, and then swaps finally into whatever asset you want on the receiving chain through a dex on the receiving chain.

Illustrated, an ETH to SOL transaction looks something like this:

Why are these the 2 superior solutions out there?

Hacking continues to be a major issue for bridges. One reason for this is what Vitalik has pointed out as the “fundamental security limits of bridges” - essentially that the higher volume and the more critical a bridge becomes, the more attractive it is to hack that bridge (as the reward increases dramatically).

There are 3 central issues with bridges that need to be solved, and essentially one way to solve it.

Liquidity

Cross-chain finality

Cross-chain security

With USBs, instead of requiring liquidity pairs for each swap, you are relying on one of the largest liquidity pools (stablecoins) as the settlement layer. This is similar in concept to Thorchain’s settlement system, except that one is relying on stablecoins instead of RUNE as the settlement layer. Here, liquidity is not an issue since the ‘bridge’ which requires stablecoin liquidity is its own stablecoin issuer.

Cross-chain finality: A problem with cross-chain swaps is that all swaps are not instantaneous and are constrained by the receiving chain’s finality. This is generally solved if the bridge or liquidity provider is willing to relax security constraints in exchange for a faster transaction, though this increases/introduces risk to those parties. However, to create a trust-minimized and more efficient environment, it becomes far easier to scale if the stablecoin issuer is able to bear the finality risk instead of the bridge. This is especially true, given that slippage may occur during the cross-chain transaction. There is less slippage involved to use a stable asset as the settlement layer since there is less value variance that needs to be accounted for.

Cross-chain security: From a technical perspective, the way the stablecoin issuer decides to build their bridge will affect how one begins to think of the added security concerns of cross-chain transactions. The options range from a ZK solution to an oracle-type solution similar to LayerZero, although it is arguable that using a mechanic that relies on a stablecoin issuer’s bridge should not additional trust assumptions. From an economic perspective, it becomes simpler to think about. If one is already comfortable with the centralization risk of Circle or Tether, then any stablecoin bridge solutions (likely semi-centralized in practice), will simply inherit the existing trust assumptions and be no more or less secure. Indeed, one can make the argument that a centralized stablecoin issuer will be obligated in practice to cover any hacked capital, if we regard USDC as a tokenized receipt for deposit tokens.

In short, we will have a bridge that will use stablecoins as the most liquid, secure, and stable means of taking on economic and security risk during cross-chain swaps.

ZK bridges will also help reduce a lot of the trust assumptions required in a cross-chain swap and are certainly in the future of bridge designs. However, even if trustless and secure, ZK bridges may have an economic disadvantage to Unified Stablecoin Bridges, given the need to accumulate liquidity for swaps.

There are two interesting takeaways:

There is an opportunity to build a stablecoin focused on cross-chain settlement

There is an opportunity to build the Unified Stablecoin Bridge

It is important to note that we should reduce reliance on non-native or wrapped stablecoins over time. Only canonical assets reduce trust assumptions since you are relying on the same entity that you previously trusted for the pre-existing stablecoin.

What do we currently have that can fulfill this need?

1inch (Pantera Portfolio) - Doesn’t do cross-chain swaps

Li.Fi - Bridge aggregators - aggregates, so doesn’t provide their own liquidity and so relies on the fundamental security/liquidity of the underlying bridges. Although they can reduce liquidity fragmentation, this is done via a number of different underlying bridge channels, which come with their own hacking risk.

Centralized stablecoin providers - Circle (Pantera Portfolio) provides native stablecoins on 8 chains. Tether provides native stablecoins on 9 chains.

Decentralized stablecoin providers - DAI. Work is still ongoing on their multi-chain expansion, with work existing on Arbitrum (Pantera Portfolio), Optimism and Starkware (Pantera Portfolio).

It is interesting that we currently do not have any player that really fulfills this need. A large bottleneck to this is the relatively slow growth of multi-chain support on the long-tail of chains, which is driven by a few factors including cost-effectiveness for stablecoin issuers. Without native stablecoin support, the incentive is for bridge providers to provide wrapped equivalents instead, thus further fragmenting liquidity. Even if cross-chain aggregators/multi-chain bridges wanted to act in a more altruistic manner and aggregate rather than issue their own stablecoins, they would still be inheriting (and transmitting) security risk of that wrapped stablecoin. This of course, ignores the fact that native stablecoin issuance requires scalable collateral management which is not something that any protocol can simply ‘do’.

One limitation of this argument is that it is likely that stableswap bridges will continue to retain an advantage for slippage/liquidity at least for some time.

There is an interesting potential for existing cross-chain infrastructure players like LayerZero to occupy this space. Given that cross-chain infrastructure players are already being used by dapps with cross-chain activity, and many of them have their own venture built bridges (like Axelar’s Satellite or LayerZero’s Stargate), they are in a strong position to distribute such cross-chain stablecoins. However, given the complexity needed to manage the regulatory and financial risk of stablecoins, it is far more likely one of these players will partner with a large institutional player to produce such a multi-chain native stablecoin for settlement.

In short, USBs have the potential to solve for the bridge trilema of liquidity, finality, and security, which could unlock meaningful cross-chain volumes and composability.

Thanks Will Reid, Arjun Chand, Alex Shefrin, Matt Stephenson, Amir Bandeali for thoughts/comments on the piece. Comments does not imply endorsement.

Chia, we’re working on this right now, albeit with a slightly different USP. As a tool for LPs to earn yield by approaching marginal APY maximization in money markets across chains.

Thoughts?