Rethinking Concentration Risk in B2B Fintech Infrastructure

Why concentration risk is a fallacy for investors looking at B2B Fintech Infrastructure companies

As more fintech infrastructure companies IPO and grow in the public markets with significant customer concentration, Akash (Augmentum) and I wanted to dive into the implications for rethinking concentration risk in the unique context of b2b fintech infrastructure companies.

We look into:

Current sentiment on revenue concentration risk

Illustrating B2B concentration risk across different segments of Fintech

Why those sentiments are wrong when examining stickiness, servicing whales, and making an alpha v beta market bet as an investor

Long-term sustainability of concentration risk for b2b fintech infra

Boundary conditions for understanding when b2b concentration risk matters

Current sentiment on revenue concentration risk

Conventional logic says that revenue concentration risk is something to be worried about. This makes sense - after all, when a customer represents a significant portion of your revenue, they hold a significant bargaining position and may drive your margins down in the long run. They may also leave suddenly, creating volatile revenue situations.

Revenue concentration risk is such a standardly accepted risk that it is one of the mandatory flags that must be discussed in a company’s SEC filing.

It has therefore been fascinating to see multiple B2B Fintech infrastructure plays go public with significant revenue concentration risk.

How do you know if your customer concentration is high or low? A rule of thumb holds that if any single customer accounts for 10% or more of your revenue or if your largest five customers account for 25% or more of revenue, you have high customer concentration.

We have seen tech companies with concentration risk biting them. Twilio losing Uber, which was 12% of their revenue source at the time, and suffering a 30% share drop at the time, is one of them. As Yann Ranchere poses the question - is customer concentration an overstated risk, or a source of alpha to be lauded?

Illustrating B2B concentration risk across different segments of Fintech

We see B2B concentration risk across different segments of Fintech. As we can observe, concentration risk is applicable across multiple verticals of fintech.

Why those sentiments are wrong

Stickiness

Growing with Whales

Explaining Alpha v Beta

Revenue Concentration should be seen as a positive feature, and not a bug, of B2B Fintech Infrastructure.

The main bear factor for b2b infrastructure plays is the churn-off problem. This basically describes the situation where smaller startups use your infrastructure solution as an interim to building their own tools, or represents a potential for volatile revenues.

The churn-off problem is uniquely mitigated in Fintech Infrastructure. Fintech infrastructure is far less turnkey than other types of infrastructure provider (e.g. Communication (Twilio), CRM (Zendesk), etc). This is especially the case for highly regulated industries like Fintech (as opposed to for e.g. a standard CRM tool). The requirements in fintech infrastructure encompass not only teams with a capacity for not just regulatory expertise, but also a capacity for specifically proprietary regulatory expertise (i.e. a regulatory moat through the creation of a new financial process/product).

This is especially true in fintech where the customers of fintech infrastructure are less familiar of the regulatory complexities of the financial product (for example in embedded finance plays), or for new financial services (Kalshi’s development of event-contracts -betting on events happening -are a good example of this).

“As for what happens if Kalshi takes off and other brokerages or other large financial institutions attempt to create their own event contract offerings, Mansour insists that it wouldn’t be so easy for them. “A lot of the work that we’ve done over the last two-and-a-half years is [intellectual property]. Every single detail of operations was built for event contracts. It would take a bit of time — especially for some of these bigger institutions — to really get into the space.” - TechCrunch

As such, fintech infrastructure is far less commodifiable, given the degree to which it abstracts the complexity and cost of regulatory compliance. In tandem with the degree of customization for customers, fintech infra is generally less likely to be a target for in-housing.

Quantitatively, this has meant that b2b fintech infra are more likely to see higher net dollar retention (NDR).

Above are the NDR numbers for the top public SaaS companies, with an average of 120%.

Marqeta’s NDR was over 200% for FY20 and FY19. Adyen has a NDR of 115-120%. Affirm has a >100% NDR.

In the SMB SaaS sector, Shopify has a 100% NDR, while its comparable SMB fintech infrastructure play like Toast has a 110% NDR. We note that a lot of our points on fintech infrastructure relate mostly to non-SMB fintech infrastructure players. Notably, although no numbers are publicly available, Toast does not have a single customer above 10% of their revenues.

(For the purposes of this hypothesis, we refer to customer revenue concentration only, and not country or product concentration)

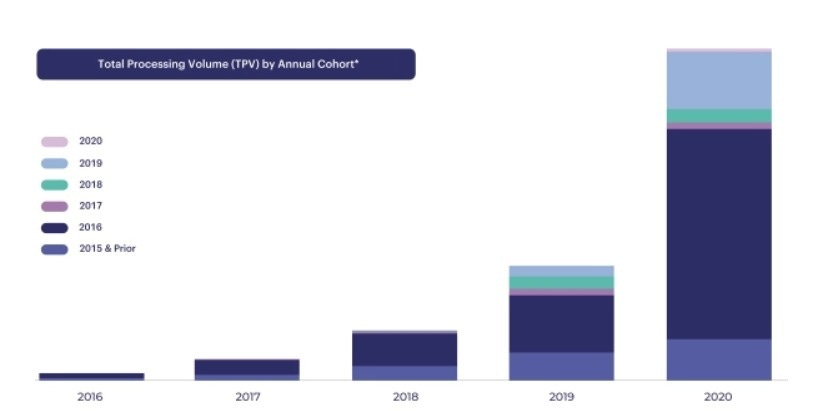

Marqeta’s TPV growth by cohort

Long term sustainability of Fintech Concentration Risk

Is it long-term sustainable? Probably not - as companies get larger, they want to prevent single points of failure, which will include their financial services or fintech infrastructure. Further, it is true that margin compression is likely to happen in the long-run. For example, Marqeta's take rate fell from about 0.7% in 2019 to 0.5% in 2020, and has dropped further since then. However, if you see whale clients as an investment in capex/capacity building to allow a platform to scale quickly from an early-stage company to one capable of large volumes of transactions, then leaning into revenue concentration as a private company is a legitimate strategy. Having built up capex/capacity to serve other larger enterprise clients positions the infrastructure platform to be able to win over other whale-type clients (which in Marqeta’s specific case, we can see in the multiple other whales they onboarded). Frank Rotman of QED pointed out that being able to “practice” with an “at-scale” client is extremely valuable and paves the way for additional contracts. Sheel Mohnot of Better Tomorrow Ventures makes a point, which I believe is especially important for infrastructure plays, that getting blue-chip logos is an obviously great way to shorten the sales cycle at other ‘whale’ clients.

The underlying risk that an investor assumes when assuming such concentration risk is that the growth rate of the ‘whale’ client is an anomaly not reflective of broader industry growth rates. However, if the investor is already willing to make a broader macro bet on a specific industry (say card-issuing), then they are already underpinned by a rising tide that is only supported by the added growth from a concentrated client, to support infrastructure/capacity building. A short-term focus on concentration risk is therefore misleading, and sub-optimal from the lens of an investor.

To illustrate Marqeta’s ability to win over existing ’whale’ clients over time, and their ability to capture upcoming whales, we see that Marqeta has been able to capture both large enterprise clients as well as selective small clients that will become whales:

At point of onboarding:

Doordash: 500m valuation

Affirm: 575m valuation

Klarna: 2.25b valuation

Square: 5b valuation

Airbase: Seed stage

Brex: Seed stage

Uber: 80b valuation

Afterpay: 4b valuation

JP Morgan: 200b startup

Marcus: ~100B in deposits

The key here is to understand that even if fintech infrastructure plays exhibit high churn rates among a long-tail of startups, that they possess an ability to remain sticky among the core group of fast-growing companies. If they have a double-churn issue (i.e. churn on the long-tail of customers, and churn after a certain scale with their fastest-growing companies), then it is more unlikely to see a path to success.

Furthermore, one of the best arguments we can make that revenue concentration does not matter for fintech infrastructure startups is actually the very fact that so many fintech infrastructure companies IPO at large market capitalizations, with significant revenue concentration. This indicates that you can build a successful IPO-able startup over multi-year periods, with significant revenue concentration, in excess of at least 30%.

Lastly, capturing Alpha is a far greater growth driver than capturing Beta. Given the sunk cost of setting up the initial regulatory and operational moat, being able to scale with that particular whale ‘alpha’ captures a faster growth rate than ‘beta’/industry benchmark growth. Yann Ranchere, partner at Anthemis, adds nuance to this argument by pointing out that ‘riding the whale’ is less about one whale and capturing the top 5/segment of potential/current industry players.

Usage-based pricing is why fintech companies are better able to extract value from their whale clients while sticking to them. Fintech infra generally has usage-based pricing, as opposed to general software that is priced on a license/seat basis. As Insight Partners’ James Woods points out, usage-based pricing allows for a natural rate of “land-and-expand” growth higher than any other form of pricing model, noting that SaaS companies across all verticals that can justify a usage-based pricing all tend to naturally have much higher net dollar retention.

“The top eight [public SaaS] companies all utilize usage-based pricing. The next best company that doesn’t utilize usage-based pricing is Zoom, which can boast a 130% NDR – that’s still less than the average of the companies that do.” - James Woods, Insight Partners

A bear case is the emergence of infrastructure-as-a-service providers like Finix, that empowers companies to be their own pay-fac’s, allowing them to more easily escape reliance on a single infrastructure provider. I foresee the main short-term bottleneck here to be regulatory and compliance capabilities by companies in utilizing such infrastructure-as-a-service providers.

Boundary conditions for understanding when b2b concentration risk matters or not

Given this specific understanding of fintech infrastructure where we’ve learnt to accept concentration risk in its growth journey, what are the boundary conditions for this principle across sub-segments of fintech infrastructure?

Fintech infrastructure that will do particularly well would:

Exhibit a strong bias for stickiness (no to low churn foreseeable for their whale-type customers)

Can identify and sell into the fastest-growing companies of its class, translating their growth into the infrastructure platform’s growth

Have a usage-based fee structure to grow alongside their clients

Scalable infrastructure (incl. Compliance, risk management, etc) to prevent being the bottleneck for growth.

Operationally or regulatorily complex

Revenue concentration risk is also highly dependent on the industry. Frank Rotman of QED pointed out that revenue concentration was, for example, not an overwhelming risk in the case of Credit Karma. Although there was a concentration of lenders to Credit Karma, the quality of Credit Karma’s leads (and in our opinion, the non-fungibility of capital sources - i.e. each lender runs similar processes), meant that there were substitute lenders that could replace any deficiency in capital sources.

An example of a B2B Fintech Infrastructure company that suffered (at least temporarily) concentration risk included Green Dot. Green Dot’s debit card program with Walmart constituted 66% of revenue and net earnings.

Green Dot shares dropped in 2012 as, right after the IPO, Walmart announced it would also additionally partner with a competing debit card issuer.

In mid-2016, the Walmart contract was extended until 2020, and in end-2019, the contract was extended until 2026. At the same time, Green Dot’s overall revenue CAGR was relatively low at ~11% between 2012 and 2020. Arguably, the difficulty in growing revenues by winning over fast-growing clients for its BaaS products violated a core boundary condition for fintech infrastructure plays - to leverage existing resources to acquire new fast-growing clients.

As an aside, this seems to have turned around in the past few years with a new CEO installed by an activist fund. Green Dot announced partnerships with Quickbooks (Intuit) and Apple in 2019, with Wealthfront in 2020. In 2021, Amazon launched a debit card product with Green Dot.

We argue that not all fintech infrastructure is equal. Below, we highlight some common features that fintech infrastructure in certain verticals may have that make the revenue concentration argument less applicable:

Low stickiness: Operational complexity that does not grow proportionate to scale

Low ability to scale with whales: An ability to scale alongside whales is crucial - encompassing compliance, customer service, risk management, etc.

Low ability to win new whales: An ability to leverage existing infrastructure to win over new whale clients.

Connectors vs. Processors: Infrastructure that connects players rather than processes operationally or regulatorily complex information or financial services may be more likely to have their services brought in-house at scale.

Sub-par macro-growth: For the concentration risk to be worth it, the whale client must be expanding at a super-normal rate to grow the infrastructure’s bottom line as well as justify building infrastructure at scale. This means that the infrastructure they are building (i.e. in-house payment processing, BNPL, etc) must be one that is reflective of a sudden supernormal macro growth trend.

In conclusion, concentration risk is a feature, not a bug, of best-in-class B2B Fintech infrastructure. They are:

Great to scale with since sticky + usage-based pricing so have less short term churn concern as opposed to non-fintech b2b infrastructure, and greater ability to capture value as whale client scales

Cashflow from Whale 1 helps build infrastructure for a growing startup to win other whales

From an investor perspective, a leveraged industry bet make sense since sticky (‘Alpha’ v ‘Beta’) and you do want to make a leveraged bet as a VC

Ignoring the above, from a pattern recognition perspective, fintech infrastructure companies have IPO’ed with significant revenue concentration, so revenue concentration should not be a concern for pre-IPO companies

Thanks to Frank Rotman, David Lilienfeld, Yann Ranchere, Andrew Starker, Natalie Luu, Sheel Mohnot for comments/input! Input does not constitute endorsement.

Well articulated @chia. In my experience, the concentration with specific customers is inevitable in the fintech and in particular B2B model. This is a nascent industry. Also, the concentration happens becoz smaller client may scale up quite fast. I as an entrepreneur have to help the client scale and be part of that journey. Team and i learn new ways of supporting bigger clients with evolving complexity. This helps acquire skill sets to acquire new type of clients. It is a constant balance between tech improvement and human engagement. As long as i can show directions approach to mitigate risks that arise out concentration, mature investors get it.