Corporate Crypto Treasuries, Lessons from TradFi, and product features to win in Web3

Understanding the spectrum of how features like custody, lending, payments, etc, have played a role in TradFi Treasury, and applying it to Web3 businesses to build.

Crypto treasuries are a fascinating new area to understand and an area we will see an entire ecosystem of tooling emerge The emergence of a new financial system implies that a generational opportunity emerges to change the way we think about how aspects of the crypto-financial infrastructure are built and won, as many of these processes are only being understood now.

Treasury management refers to the broad act of managing the pool of funds that are on their balance sheet. Software in this space are essentially CFO-in-a-box type services that help companies understand the state of their treasuries. Legacy general enterprise companies in the TradFi space include the large enterprise tech players, Oracle, Microsoft etc, and smaller specialized legacy players like Kyriba, HazelTree, etc, that help CFOs understand the state of their treasuries. Owning CFO mindshare of treasuries is important as the opportunity to win the IoS for Finance.

There are 3 main things that I wanted to understand today:

A. Who are the main category of customers for crypto treasuries?

B. What are the different products/initial business models that are a wedge into crypto treasury mindshare?

C. What are history lessons from TradFi that can help us understand treasury mindshare?

#A:

The creation of crypto currencies have given rise to 4 main categories of corporate customers that would touch crypto in some way:

Fiat -> High yield stablecoin staking accounts (Traditional companies that want crypto yield but not assets)

Fiat -> Crypto -> Crypto (Institutions that want to active trade crypto)

Fiat -> Crypto (Institutions that want crypto assets but not day-trade)

Crypto -> Crypto (Crypto-native orgs that are mainly crypto-treasuries without touching much fiat)

1 are Corporate defi mullets. Defi mullets are defined as platforms that appear to feel like traditional fintech companies from the perspective of the user (in terms of user experience and processes), but that leverage Web3/crypto mechanics on the backend. The target customers here are traditional businesses with little interaction with the Defi ecosystem.

With the rise of an entire ecosystem of stablecoin savings accounts, corporate defi mullets like Meow have emerged, offering crypto-like interest rates for fiat deposits.

2 refers to financial institutions that are actively trading and have a need for portfolio visibility across a range of ever-changing assets. The target customers here are financial institutions that could include hedge funds and family offices that are actively trading crypto assets.

3 refers to financial institutions that are looking to get long-term exposure to the crypto asset class, but do not see themselves as active traders. The target customers here are financial institutions that could include large corporates who are looking to merely diversify their treasury base and would typically hold their crypto positions for a long period of time.

4 refers to crypto-native organizations that have little interaction with fiat, and predominantly hold native-tokens, ETH/BTC, stablecoins, etc. The target customers here are organizations that would include companies that raised solely from ICOs, DAOs, and generally crypto-native organizations. Within this segment, we have seen DAO treasuries expand from 400m to 16B in less than a year in 2021, and we are only just getting started.

#B/C:

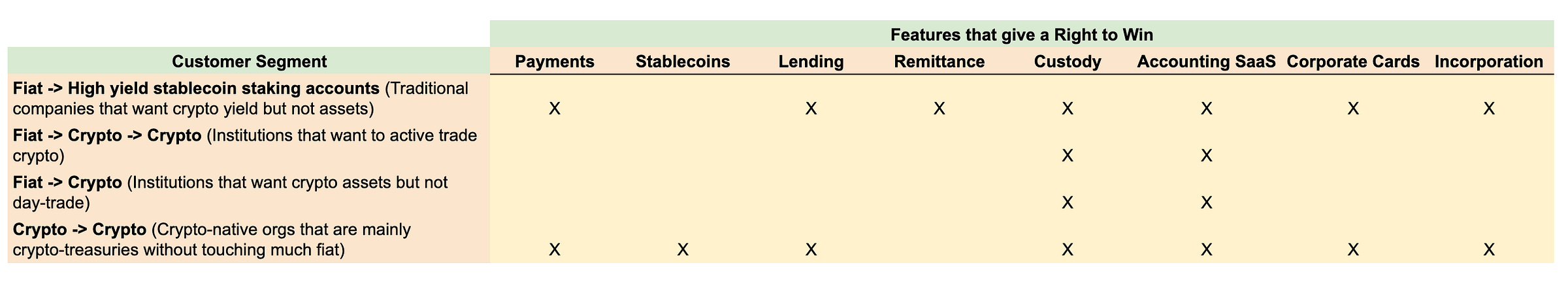

We will now explore the product features that give rise to winning in crypto treasuries across the different customer segments above in #A.

Typically, corporate treasuries have been won in the following ways:

Custody

Dedicated Accounting/Payroll Software

In Traditional Fintech, we have recently seen the emergence of the following features to win Treasury Mindshare

Payments

Lending

Remittance

Corporate Credit Cards/Expense Management

Incorporation

And discuss the unique Web3-native aspect of Stablecoins

Summary of Right to Win - If I were to build a crypto treasury company, what features can I first build-out to appeal to which customer segments?

Custody

TradFi: Custody would appear to be the most obvious and easiest way to own the treasuries space. Banks are the most obvious example of how they became the main interfacing layer between Financial Institutions and their crypto treasuries. All SMB neobanks fundamentally see being able to be the primary deposit account for SMBs as the holy grail for trust and thus being the IoS of Finance. Most TradFi Fintechs try to focus on improving the user experience of opening or navigating the banking experience.

Crypto: Similarly in crypto, and exchanges like Kraken, Coinbase, and Matrixport were able to quickly be the main interfacing layer between Financial Institutions and their crypto treasuries. Although the primary use case of exchanges was to trade assets, many of these exchanges also became the de-facto custodians for financial institutions.

Even non-custodial solutions like hardware wallet companies, solving the problem of custody, found themselves in a great position to upsell enterprise treasury solutions. Ledger, for example, built out the Ledger Enterprise software solution off the back of its hardware cold wallet solution.

Hypothesis of Opportunity: Custody is a well-understood process and an obvious wedge. We have seen treasury management solutions emerge naturally from custodians in both TradFi and Crypto, and should continue to see them as being able to win the lion’s share of the treasury management space.

Dedicated Accounting/Payroll SaaS

TradFi: Dedicated Accounting Software can range from the expected - from leveraging Microsoft/Oracle/Kyriba/Novantas - to the unexpected - with players like Khatabook and Bukukas leveraging simple accounting software to win over SMBs.

Crypto: Dedicated Accounting infrastructure is still relatively new but an obvious pain point. Companies like Multis, Utopia, Coinshift, Gilded Finance are trying to build accounting and payroll offerings for crypto-native treasuries.

Hypothesis of Opportunity: Starting with payroll, we are starting to see nuances in crypto accounting SaaS development. Just as payroll (especially for crypto native companies where labor is typically the main costs) was the natural wedge product for most TradFi fintechs to break into corporate treasury management, crypto payroll has represented the most obvious wedge product to first solve. Taking inspiration from Tradfi treasury management plays, other product vectors that are emerging will likely include treasury risk analytics, liquidity management for incentive programs, tax and audit analytics, and account receivable management. More financially focused generally applicable analytics like tax and risk analytics would be more broadly appealing to all segments of potential customers (e.g. traders, tradfi and crypto-native companies).

A specific use-case that is uniquely found among crypto-native treasuries would also be around providing transparency standards. In order to uphold the ethos of decentralization and transparency, crypto native treasuries will increasingly find themselves pressured to provide easy transparency into DAO treasuries, representing an opportunity for the ‘Blockexplorers’ for DAO/crypto-native treasuries.

Payments

TradFi: Payments has emerged as a fairly unusual way to win over treasury. Bharatpe became a 3B unicorn by leveraging their QR code payment system to persuade MSMEs in India to avail of their high-yield (12%) interest account offerings. The initial trust derived from helping businesses move money allows them to naturally upsell treasury services, typically starting with the float already captured within the payment ecosystem.

Crypto: Interestingly, at least for consumers, payments has also appeared for ‘retail treasuries’ with Chai payments offering a high-interest rate for fiat that users deposit into their Chai payment e-wallet.

Hypothesis of Opportunity: Similar to how Chai executed for consumers, and Bharatpe executed for SMBs, merchant payment gateways may represent a way to enter treasury management for both crypto-native companies, as well as the most natural crypto on-ramp for traditional companies looking for cheaper payment rails. As an example, a merchant gateway can offer to provide yield for the float that merchants have on that merchant gateway.

Furthermore, because of the vast nature of tokens out there, crypto-native companies looking to make payments in native tokens would see value in payment gateways that provide automatic settlement into a currency that the merchant wants to receive in (i.e. only USDC), as opposed to having to incur gas fees twice, in first converting into the receiving currency and then sending said currency across to the receiving merchant.

Lending

TradFi: Lending has also emerged as an interesting wedge case in a similar way to Payments. SMB neobanks like Koinworks, Validus and Aspire emerged out of an initial SMB lending platform, building the trust to justify managing treasuries. Factoring/lending companies like Capchase are also seeing opportunities to build out treasury management solutions.

Crypto: Due to the nature of how lending emerged in crypto, first emerging (and currently still mainly focused) around overcollateralized lending. Overcollateralized Lenders have tended to emerge out of custody-first companies, and have started to offer some treasury services - like Tesseract’s Earn product. We have yet to see undercollateralized lending-first crypto companies mature to the point that treasury management products have emerged from these platforms.

Hypothesis of Opportunity: This could however emerge as newer forms of lending emerge and popularized. It is interesting to note that the same dynamic of undercollateralized credit constraints that created lending-first neobanks in emerging markets Asia is replicated in the undercollateralized credit constraints found in crypto, hinting at the potential for undercollateralized lending models moving into crypto SMB neobanks. Undercollateralized lending platforms could be well-positioned to win over treasury management in the same way that SMB lenders in TradFi branched out to win treasury management. Companies that focus on providing lending services could branch themselves out into a SMB neobank.

Specialized crypto lenders like undercollateralized lenders to DAOs may also represent a great wedge to win over DAO-specific treasury management.

Remittance

TradFi: Remittance has emerged as an area to win over export/import oriented neobanks. SMB Neobanks like Airwallex, Neat and Wise all began as companies fundamentally solving remittance issues before expanding into a neobanking product suite.

Crypto: Remittance has never emerged as a key area of concern for companies moving digital assets across borders, given the borderless nature of digital assets. The closest relevant business model would likely be off-ramps, but this would represent a poor wedge given that the value of off-ramps is derived from firms looking to exit into the TradFi ecosystem.

Hypothesis of Opportunity: However, one customer segment remittance would be relevant to would be for traditional companies looking for cheaper remittance solutions. By leveraging the crypto promise of cheaper remittances, corporate treasuries could be won over in a similar way that TradFi remittance-first neobanks developed. A product evolution along this logic could be imagined as the following: Crypto remittance mullet -> defi mullet neobank offering defi-returns based on stablecoin staking.

Corporate Credit Cards

TradFi: The opportunity set of corporate credit cards as an initial wedge to win over corporate treasury is clear - multiple unicorns with incredible traction have been born in this space in a relatively short time through Brex, Divvy, Ramp, etc. Credit Cards as a way to win expense management software, as a way to win general treasury management is well understood. Companies like Brex have even moved into providing TradFi companies crypto exposure

Crypto/Hypothesis of Opportunity: The opportunity in Crypto is less direct. Brex for Crypto-native companies has certainly been discussed actively, but I believe there are a few temporary obstacles that currently suppress this opportunity set. KYC for employees/DAO contributors who wish to remain anonymous, the immaturity of DAO organizational processes today, and workflow processes around multi-sig wallet security represent some of the structural and temporary difficulties for building a crypto-native Brex. It is arguable that as DAOs/crypto native companies mature, we will see a Brex for crypto overcome some of these obstacles.

Stablecoins

TradFi: The equivalent of Stablecoins are the Central Banks, which would not play a major role in the daily operations for corporate treasuries. Corporations receive the fiat currency that are needed for daily operations simply from their equity or debt stakeholders.

Crypto: In Crypto, however, the need to hold or access stablecoins for working capital requirements (for example, payroll) is a need more acutely faced by crypto-native companies. Although it is possible to build a stablecoin treasury by exchanging native tokens or ETH/BTC through exchanges, companies may also simply work with stablecoin issuers directly like Circle, Maker, etc.

Hypothesis of Opportunity: As a result of such a direct relationship between stablecoin issuers and companies (in a way that does not exist in TradFi), stablecoin issuers are in a great position to upsell treasury management solutions (since they are directly feeding into the treasury). We have seen this with Circle launching enterprise treasury solutions for both crypto-native companies and traditional companies looking to get crypto exposure/yield.

Incorporation

TradFi: Fintechs have been looking to incorporation services as part of an easy way to win over custody, by bundling custody/bank account services with incorporation services as seen in Stripe Atlas, Mercury, Aspire.

Crypto: Incorporation is a less clear problem statement in crypto, especially as the regulatory framework, and market appetite for censorship risk is still being developed. As of the time of writing, especially in the case of DAOs, some level of legal entity is desired for reasons of providing liability shields, and employee benefits. As a result, there has been an entire industry of platforms, like Syndicate DAO, dedicated to helping spin up/incorporate legal entities for DAOs and other crypto-native companies.

Hypothesis of Opportunity: Understanding legal and incorporation needs represents a tricky problem statement for crypto-native companies and represent a well-understood wedge to occupy treasury management.

In conclusion, we can see that lessons from TradFi are useful to understand the range of product features that might emerge to win in crypto treasuries, across multiple customer segments with very different use-cases, needs, and starting points.

Crypto treasuries is certainly a multi-winner space, even in specific customer segments, and it would be interesting to see how, as businesses continue to accumulate significant crypto assets and demand greater tooling to manage their balance sheet.

Thanks to Saket Kumar, Mike Giampapa, Zeynep Yavuz, Wellington Scully, Pavir Patel, Sharon Lourdes Paul, Eric Lim, Dan Schlabach for thoughts/input (Input does not mean endorsement)